The crypto market is reeling from the devastating effects of last week’s plummets. That the market spectacularly fell after an encouraging first two months of the year came as a shocker.

Coronavirus Impact

Evidently, the world had underestimated the effects of coronavirus whose origin can be traced to China. There, the virus devastated lives, disrupted work flow, caused panic, and is has now spread to Europe and Africa.

Europe, especially Italy, is under lock-down and their government has announced a stimulus package. Fiat will be affected and here, Bitcoin and other quality assets like Ethereum, analysts believe has a chance to cement their significance.

Ethereum is specifically ravaged. Last week, the coin sunk over 40% week-to-date but there is confidence thanks to the fact that it is a quality project and a foundation of a new innovation, DeFi.

Maker and DeFi Rely on ETH Price Performance

From here, these finance applications that are finding use by the day, depend on the performance of the underlying asset, ETH. Should it spring back into positive territory, DeFi apps and more so, Maker, whose token set for auctioning today, may spring back to life.

Because of last week’s drawdown and Ethereum ceasing to function as the network clogged, MakerDAO’s smart contract guiding auction of collateral is estimated to have lost over $4 million as some keepers took advantage of the situation and placed zero bids.

ETH/USD Price Analysis

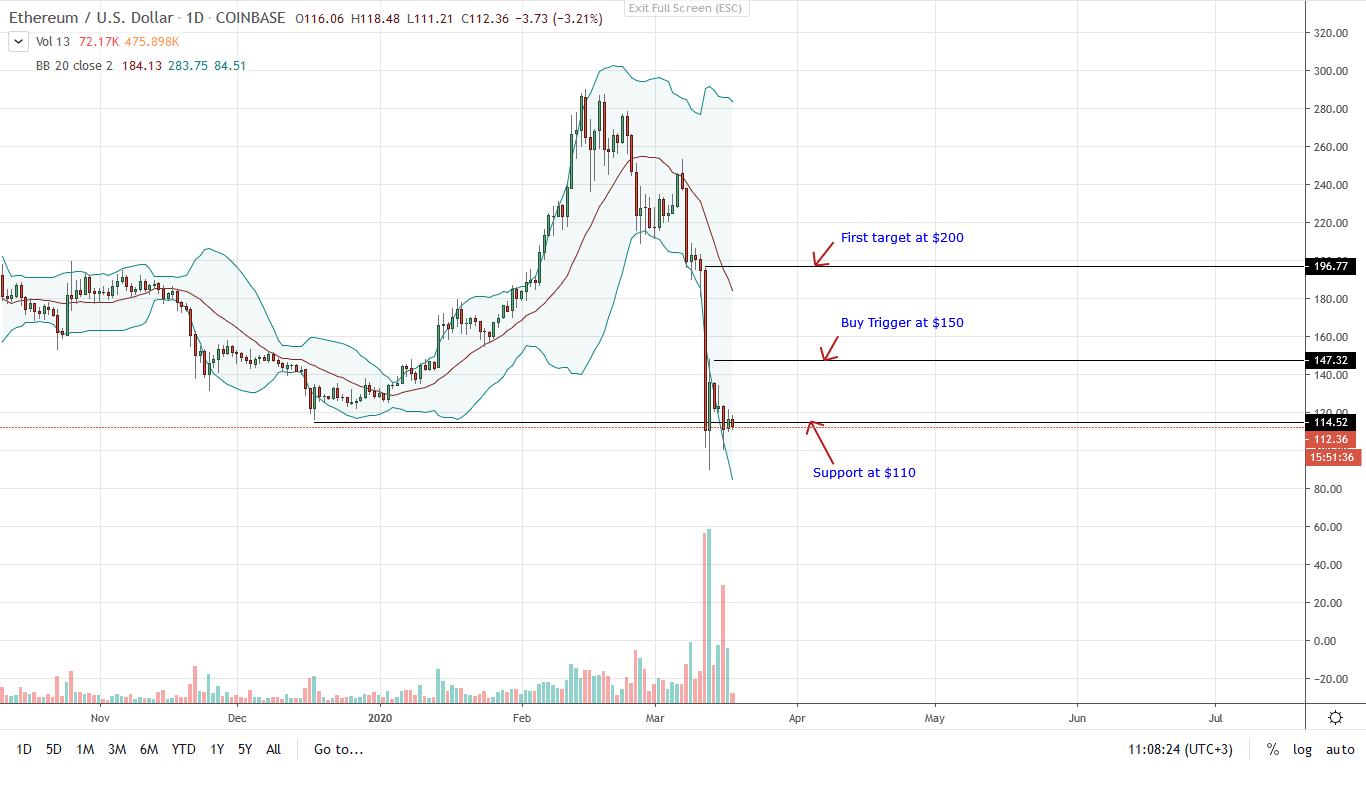

Ethereum [ETH] price remains bearish and price action bound by Mar 12 bear candlestick. As prices hover around $110, H2 2019 main support line, traders can only remain on the sidelines.

From the chart, there is a little bit of support but candlesticks are banding along the lower BB meaning bear momentum is strong.

But there is more than that. As long as prices are still trending inside the humongous bear bar with light volumes, there is risk that bears will force prices below the main support line to sub-$100.

In that eventuality, ETH may crumble to Dec 2018 lows of around $70 before rebounding—or worse printing new lows. In light of this, the best course of action is to remain neutral.

Aggressive traders can begin loading dips once ETH recovers past $150 or Mar 13 highs. Immediate target will be $200 or Mar 12 high.

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.

The post Ethereum [ETH] Price Analysis: Retests H2 2019 Lows as Coronavirus Tests Economies’ Resilience, $70 Incoming? appeared first on Crypto Economy.